What Could the Venture Market Look Like in the Coronavirus Era

Tom Tunguz

MARCH 11, 2020

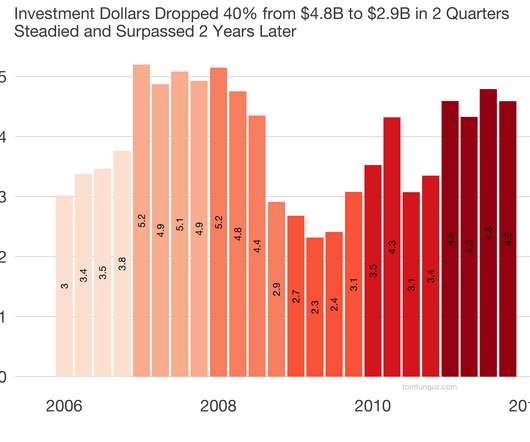

Let’s look at the data. That grew to about $5B per quarter in 2007 and early 2008. This might be for a few reasons: valuations fell, no need to reprice/recap companies, and typically recessions are great markets to start startups. In 2008, I had just joined the venture industry, and then Lehman fell.

Let's personalize your content