Just Being Pretty Good at Venture Capital Isn’t Good Enough

SaaStr

SEPTEMBER 12, 2024

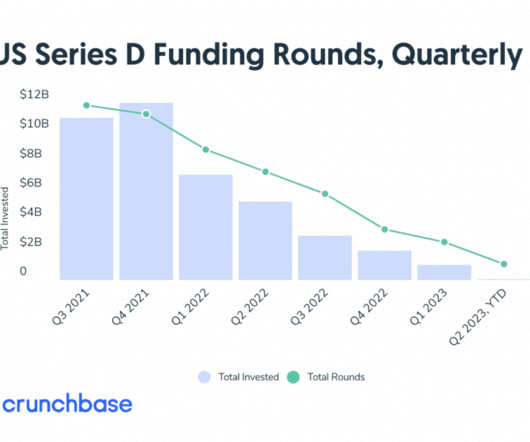

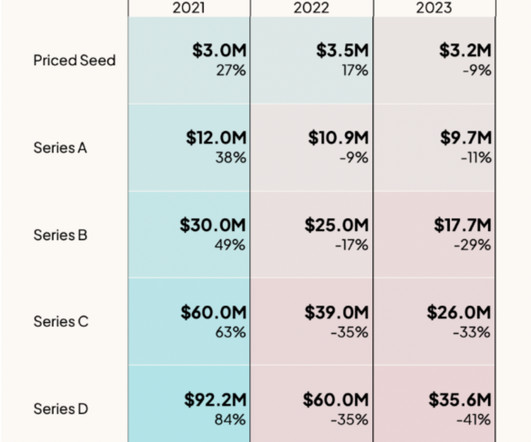

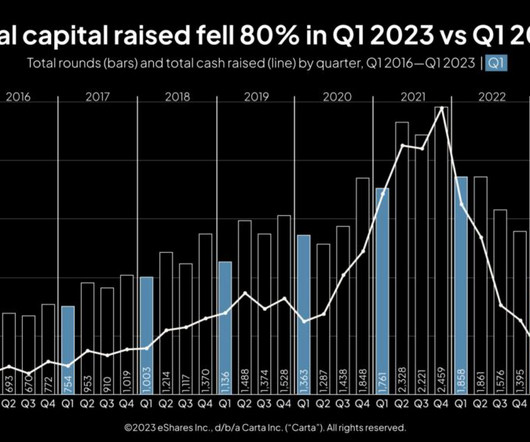

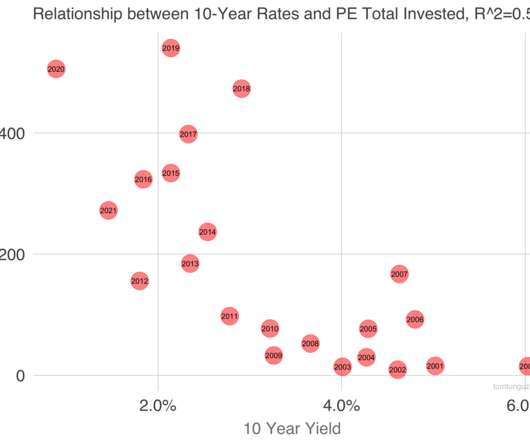

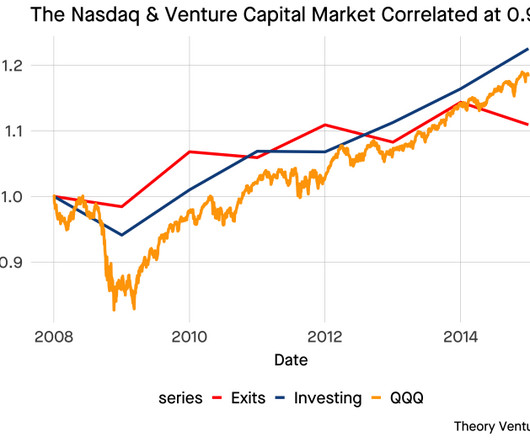

More here from Carta: The post Just Being Pretty Good at Venture Capital Isn’t Good Enough appeared first on SaaStr. The median 2017 fund is making money on paper, but not enough. And 2020 and 2021 funds look a little … rough right now. Maybe a lot rough.

Let's personalize your content