Three Ways SaaS Organizations Can Create Recurring Revenue Without Spending a Dime

USIO

JULY 1, 2024

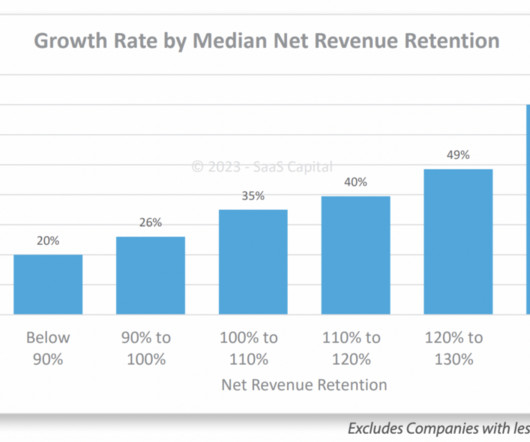

In the competitive world of Software as a Service (SaaS), generating recurring revenue is essential for sustainable growth. Here are three ways SaaS organizations can create recurring revenue without spending a dime. By focusing on customer satisfaction and reducing churn, SaaS companies can maintain a steady revenue stream.

Let's personalize your content