Dear SaaStr: What’s a Good Benchmark for B2B Sales Cycles?

SaaStr

JANUARY 18, 2023

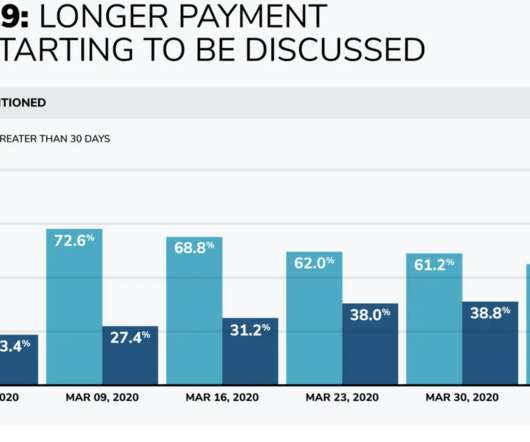

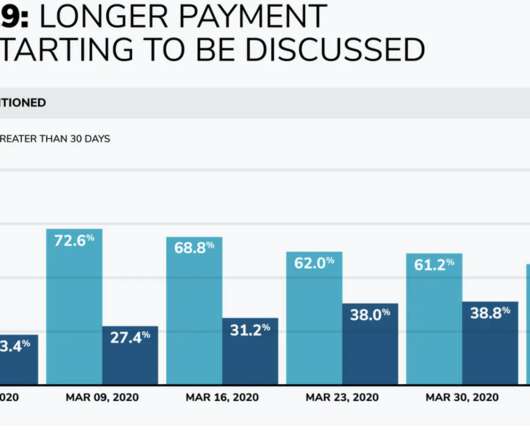

Dear SaaStr: What’s a Good Benchmark for B2B Sales Cycles? More here : The post Dear SaaStr: What’s a Good Benchmark for B2B Sales Cycles? To overgeneralize, but to give you a pretty rough sense: Sales cycles are very much impacted by the intent of the prospect. If the business process change is HUGE (e.g.,

Let's personalize your content