Fenwick: Down Rounds Aren’t Really Happening Much. But Later Stage Prices Have Fallen Quite a Bit.

SaaStr

AUGUST 26, 2022

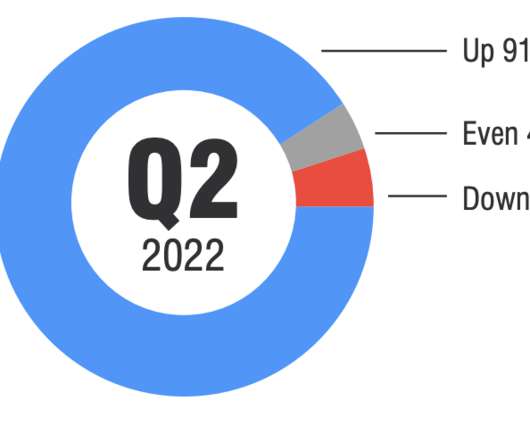

Series B and later prices are down across the board from their peaks in 2021 and Q1’22, down 30% or more. Fenwick’s blended numbers see overall Series B and later round pricing down about 30%. #3. But overall, valuations and prices post-Series A still remain way ahead of where they were up until 2018.

Let's personalize your content