From 0 to $500 Million ARR in 6 years: Learnings from Innovating in Underserved Markets with Samsara CPO Kiren Sekar (Pod 549 + Video)

SaaStr

APRIL 22, 2022

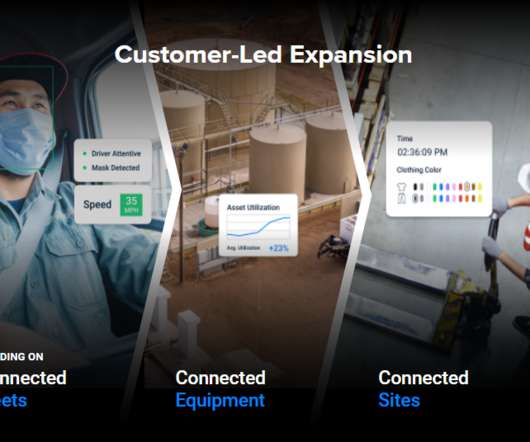

Applying the lessons from Meraki, Kiren will share how Samsara broke into the under-served world of physical operations, the importance of customer feedback, a multi-product strategy, and why culture matters. But at Samsara, the customer feedback strategy became a directive, an important guiding function of company and product growth.

Let's personalize your content