Office Hours with Lee Kirkpatrick, former Twilio CFO on Managing through Turbulence

Tom Tunguz

JUNE 14, 2022

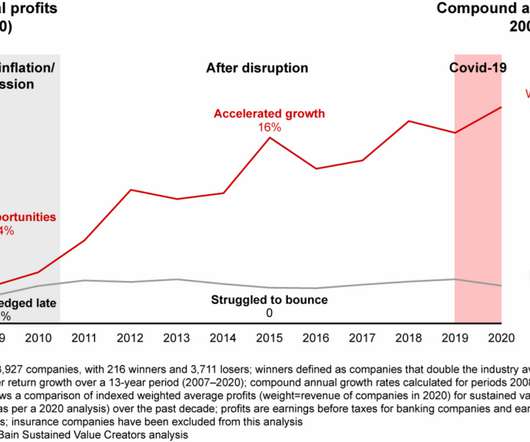

During the dotcom crash in 2001, the Global Financial Crisis of 2008, and the SaaS corrections in 2014, 2016, and 2018, Lee was either COO/CFO or CFO at Twilio, SAY Media, and Ofoto. Lee Kirkpatrick is no stranger to downturns.

Let's personalize your content