Does SEO Still Work? Our Data Says “Yes But”

SaaStr

JULY 21, 2024

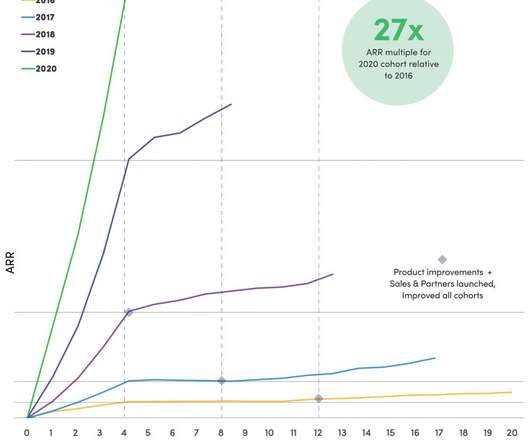

Which is that we have literally 100x more quality content than 2011-2014. Organic Search remains our #1 source of SaaStr readers for 13 years straight: But, I can also tell you what our data says. Our content page ranks remain high. And we’ve actually increased our output.

Let's personalize your content