How Much Are Integrations Costing Your Company? (Part 1)

Saasler

OCTOBER 12, 2016

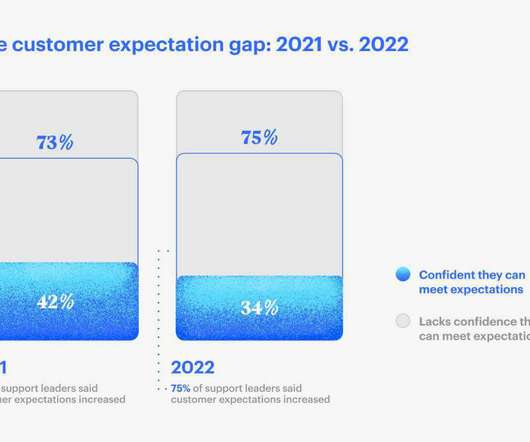

The concept of building third-party integrations is quickly shifting from being thought of as an added value to becoming a critical element in the SaaS landscape. In fact, a successful integration ecosystem has the power to influence many aspects of the business, including customer satisfaction, retention, and churn rates. Intricacy

Let's personalize your content