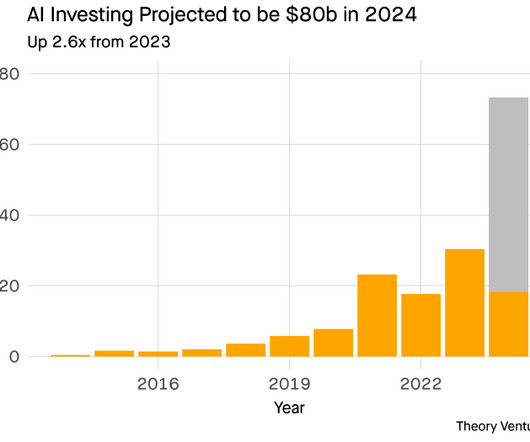

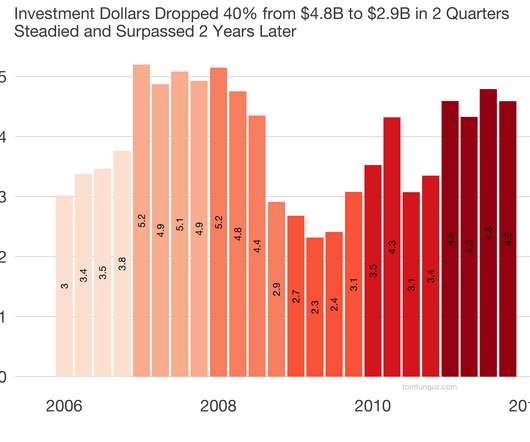

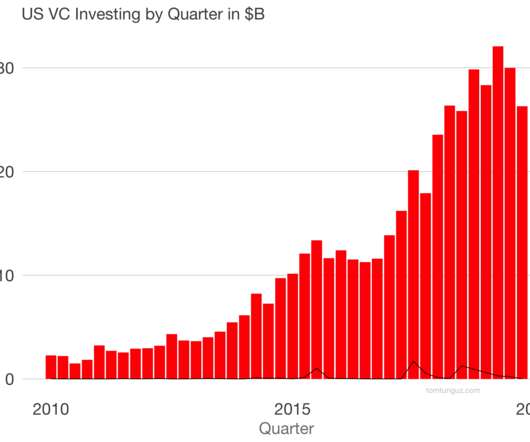

The Fastest Growing Category of Venture Investment in 2024

Tom Tunguz

MAY 8, 2024

The fastest growing category of US venture investment in 2024 is AI. Venture capitalists have invested $18.3 AI startups now command more than 20% share of all US venture dollars across categories, including healthcare, biotech, & software. billion through the first four months of the year.

Let's personalize your content