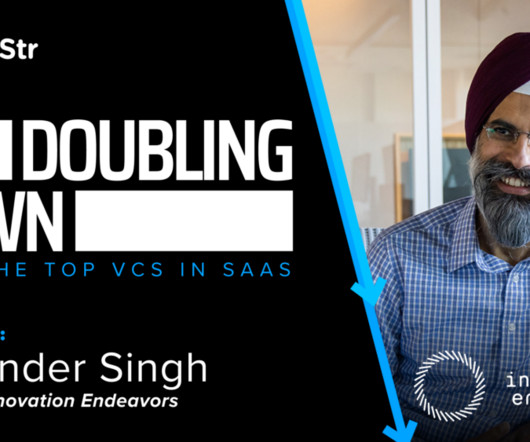

Dear SaaStr: When Do You Start to Develop a Brand in SaaS?

SaaStr

MARCH 2, 2023

Dear SaaStr: When Do You Start to Develop a Brand in SaaS? At that point, you don’t have a world-famous brand or anything. But you do start to have a “mini-brand”, where folks in your top niche or segment start to have heard of you. If your product costs $20,000 a year, your mini-brand might kick in around 100 customers.

Let's personalize your content