The 250,000 Customer Club: How HubSpot and Monday.com Both Created SMB+ Empires

SaaStr

MAY 20, 2025

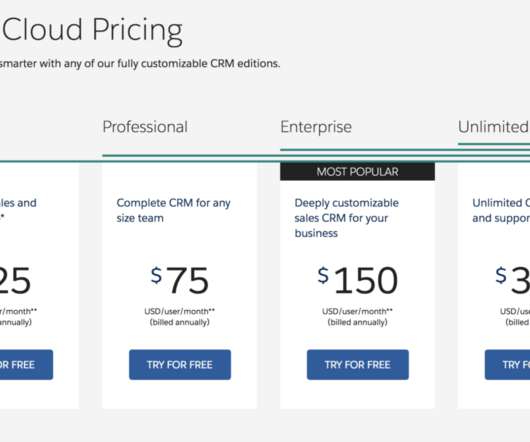

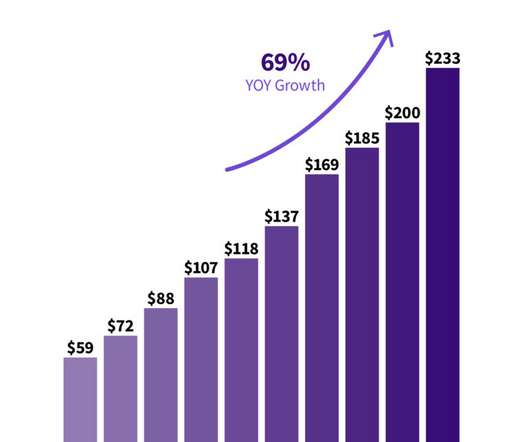

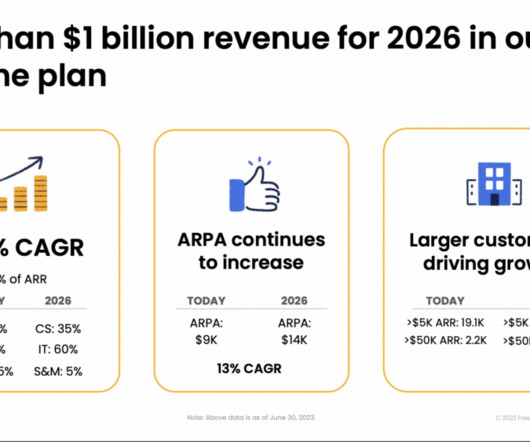

HubSpot has achieved jaw-droppinggrowth with a 29% revenue CAGR from Q1 2019 to Q1 2025, growing from $152M to $714M quarterly revenue. Create Multiple Revenue Expansion Levers : Successful SaaS businesses need multiple ways to increase customer lifetime valuenew products, tiered pricing, usage-based components, and cross-sells.

Let's personalize your content