The Sheer Momentum You Need For an Enduring IPO in SaaS: 63% Average Growth

SaaStr

JULY 19, 2025

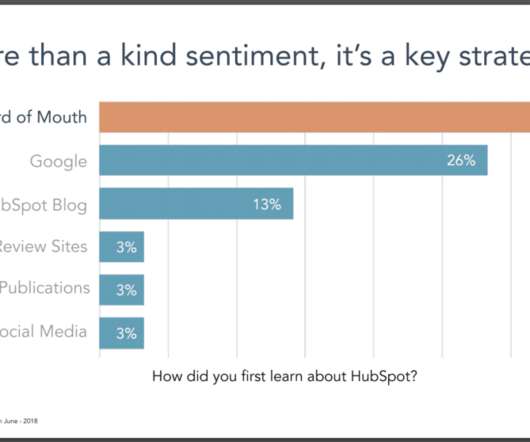

And the best of the generation prior to that: Bonus: HubSpot (IPO: October 2014) Pre-IPO Year Growth Rate: 39% Revenue Growth : ~$51.6M (2012) → ~$71M (2013) IPO Valuation : ~$900 million Business : Inbound marketing and CRM platform HubSpot achieved amazing revenue growth in their first 7 years as a company growing by more than 12x from $5.7M

Let's personalize your content