The Salesforce/Mulesoft Acquisition is a Bellwether for the 2018 M&A Market

Tom Tunguz

MARCH 19, 2018

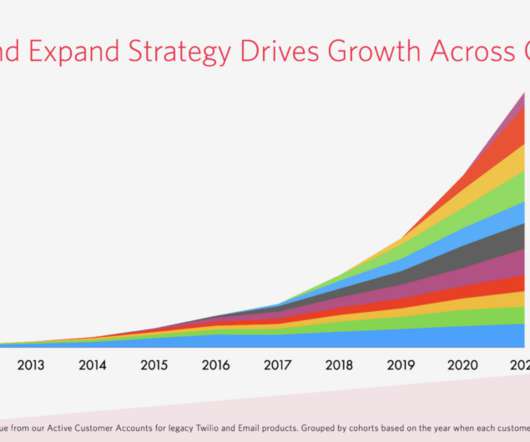

Year of Acquisition. If we compare this acquisition on other dimensions, we see that Mulesoft is the second fastest growing at the time of acquisition, next to SuccessFactors in 2011. In the first three months of 2018, we’ve witnessed two multibillion dollar software acquisitions. Transaction. Price ($M).

Let's personalize your content