What Could the Venture Market Look Like in the Coronavirus Era

Tom Tunguz

MARCH 11, 2020

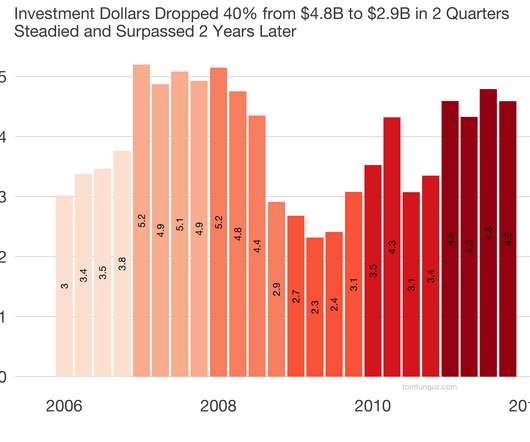

That grew to about $5B per quarter in 2007 and early 2008. Let’s break down the trends by series. Then the investing velocity fell by half to $2.9B, $2.7B, and $2.3B in the quarters following the crash. The market bounced back to similar levels once in Q2 2010, but needed eight quarters to return to its previous volumes.

Let's personalize your content