How VCs Value Rainbow Foals in 2022

Tom Tunguz

JUNE 20, 2022

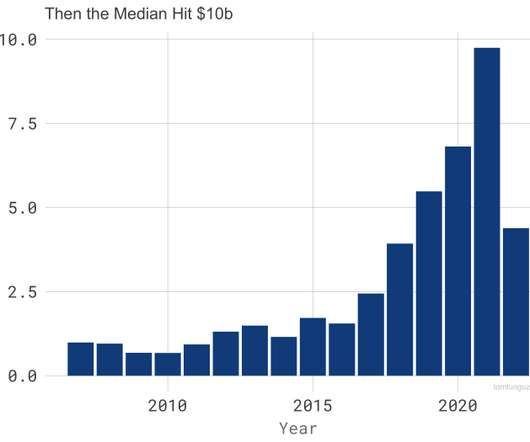

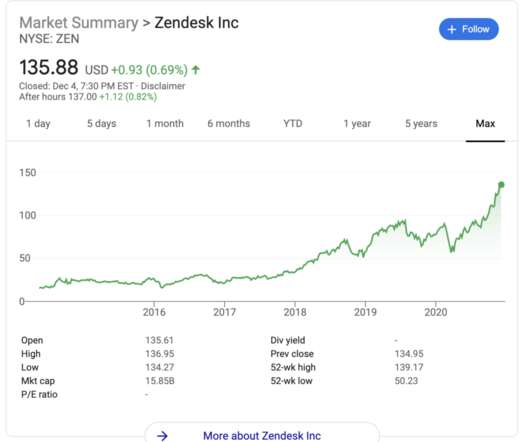

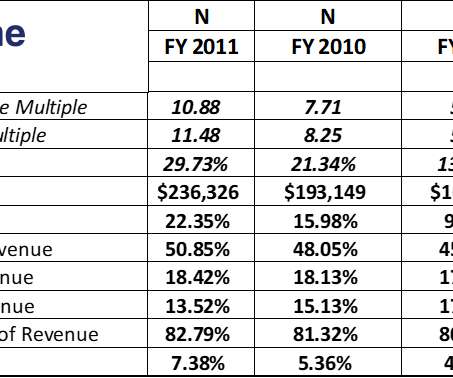

From 2007 to 2016, $1.5b marked the upside case for most VC software and infrastructure investment memos. Fewer than 15 SaaS companies traded on public exchanges then. With at least 20 firms and several partners per firm chasing unicorns, upstarts faced stiff odds. 2015 Return Multiple by Round. Return Multiple at $1.5b.

Let's personalize your content