Do SaaS Startups Still Require Less Capital than 10 Years Ago?

Tom Tunguz

APRIL 1, 2019

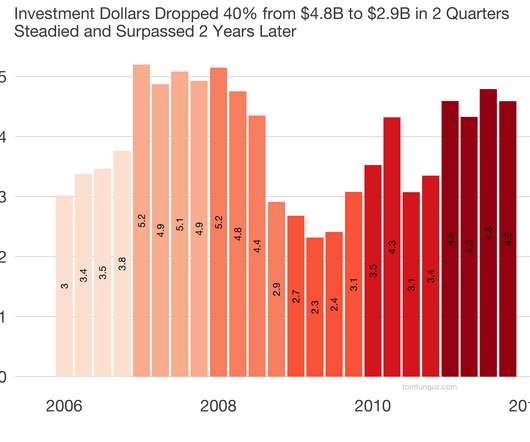

In 2014, I published a post called Do Startup Require Less Capital to Succeed than 10 Years Ago ? Startups going public from 2006-2009 showed a median ROIC of 0.42. The era after 2006 and through the 2008 financial crisis was a different time to raise capital. The chart above updates that analysis. of revenue at IPO.

Let's personalize your content