How SaaStr Fund-Backed RevenueCat Went from a $1.5M Round at $7M Valuation in 2018 to $500M+ Today

SaaStr

MAY 23, 2025

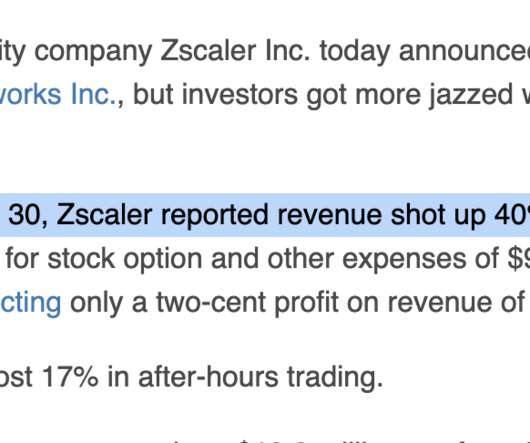

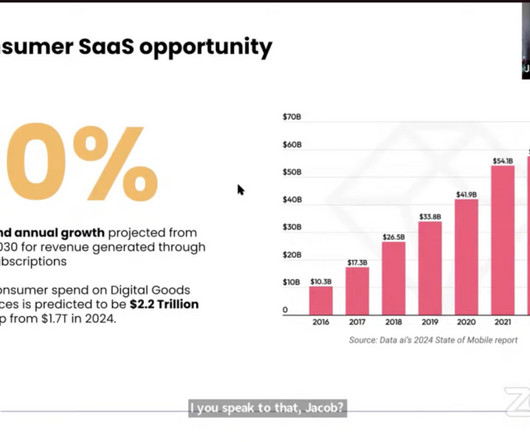

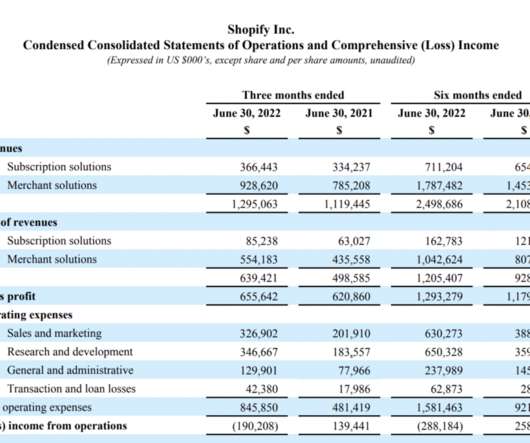

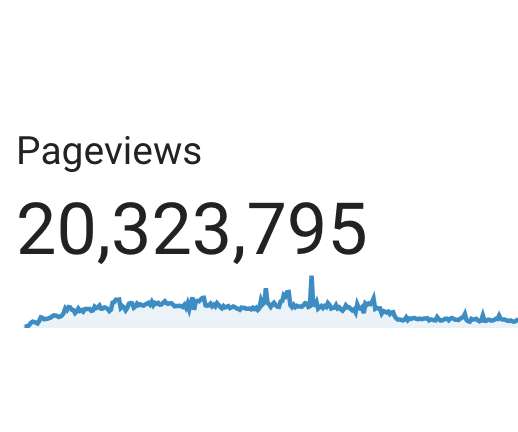

When SaaStr Fund made the first investment in RevenueCat back in 2018, nobody could have predicted that this “simple API for managing in-app subscriptions” would become the infrastructure powering 33% of all mobile subscription apps and reach a $500M valuation in 2025. ” required weeks of developer time to answer.

Let's personalize your content