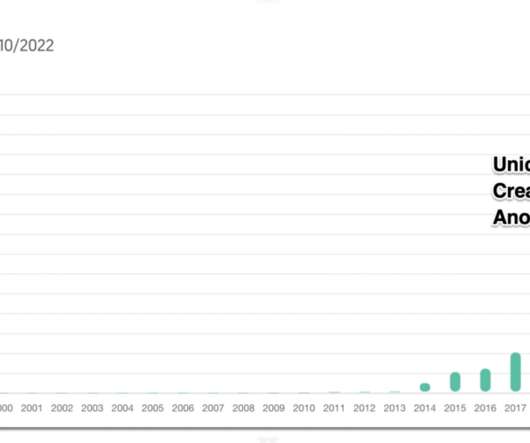

The Startup M&A Market Fell 94% Year over Year - But One Segment is Thriving

Tom Tunguz

JANUARY 4, 2023

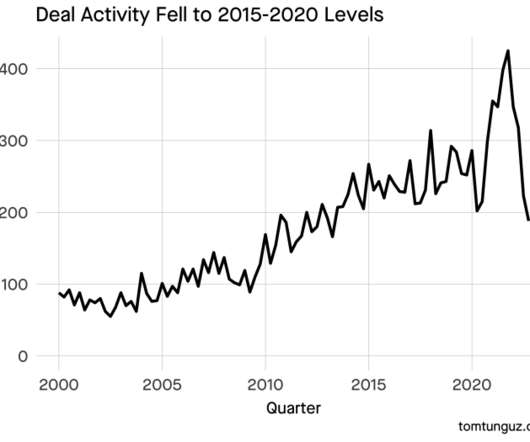

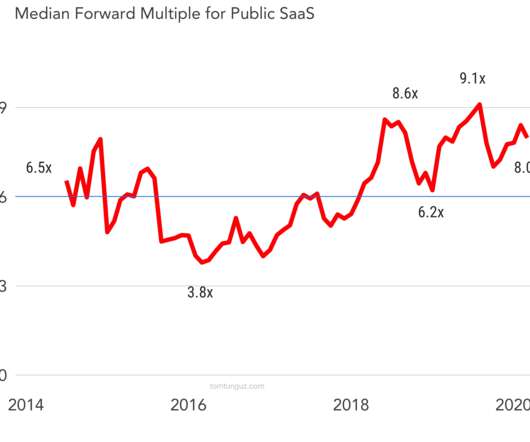

The US startup M&A market in Q4 2022 was one of the quietest in the last 20 years. During a down-market, young startups who face a radically more challenging fundraising market than six months ago more often choose a quick sale. It rivals the dotcom bust & Global Financial Crisis for its paucity. in Q4 2021 to a paltry $2.1b

Let's personalize your content