SaaS Cybersecurity Due Diligence

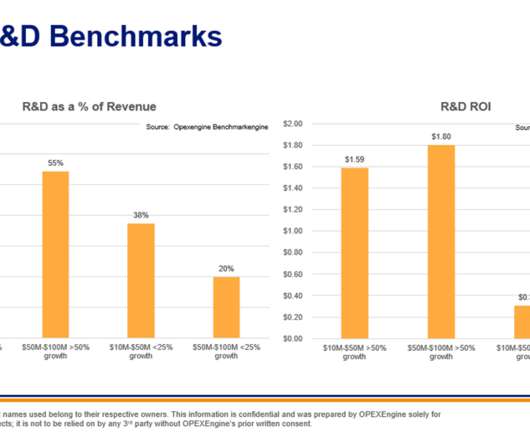

OPEXEngine

FEBRUARY 27, 2020

You, the CFO of a mid-sized SaaS company have spent the last 2-3 years getting your financials, your retention, CAC and other key metrics, in shape so you are offered an attractive valuation multiple. Now comes the final due diligence, including a cybersecurity review. Cybersecurity Due Diligence.

Let's personalize your content