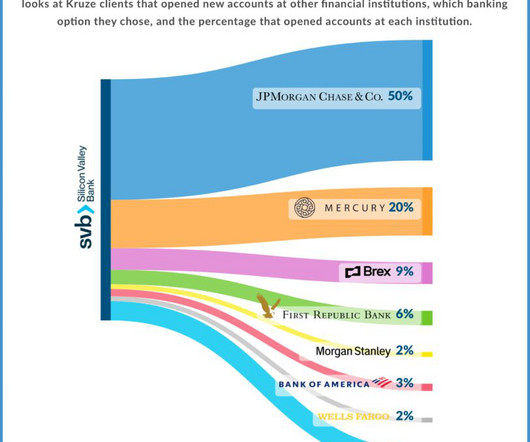

Where Did Startups Put Their SVB Cash? At JP Morgan Chase

SaaStr

MARCH 28, 2023

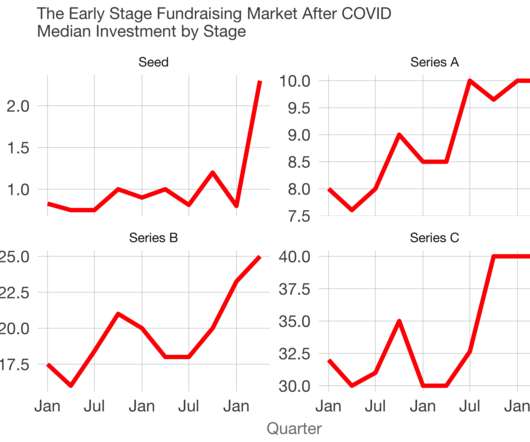

SVB failing was a stunning moment in the history of startups. The bank startups had used for decades. A week ago this morning, our bank balances still read as follows: pic.twitter.com/h4kTDaDFeb — Jason Be Kind Lemkin (@jasonlk) March 19, 2023 So … where did startups that took out their cash put it?

Let's personalize your content