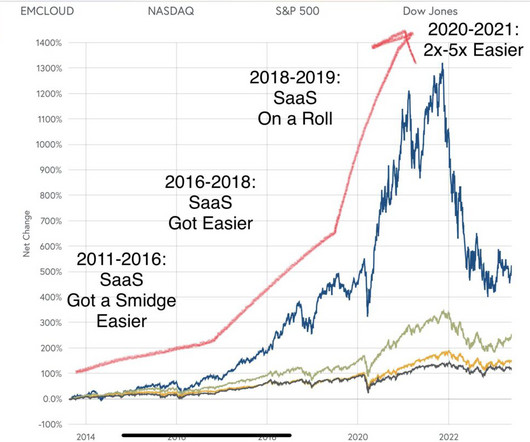

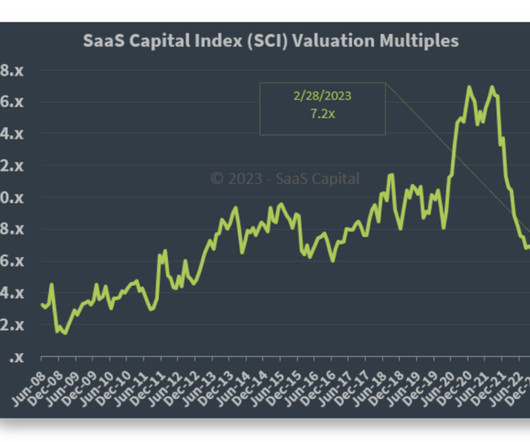

How Will a Venture Capital Recovery Feel? Observations from 2008

Tom Tunguz

AUGUST 6, 2023

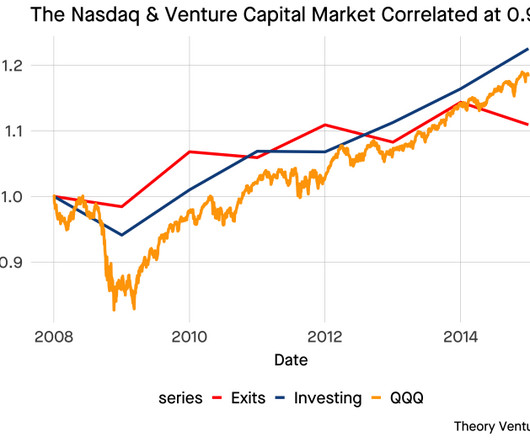

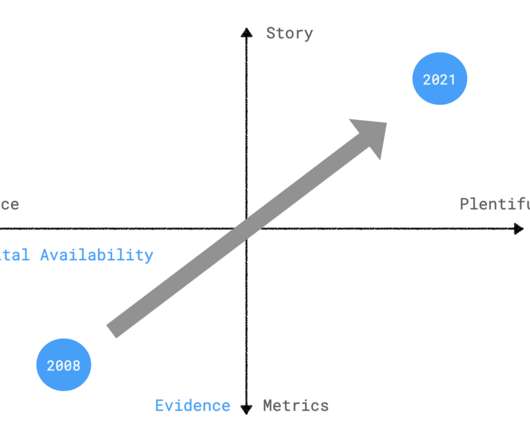

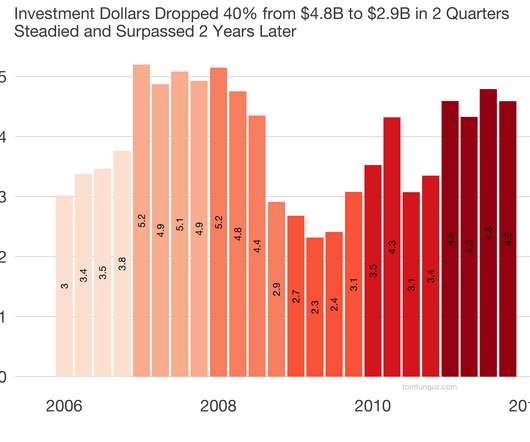

In 2008, I had just become a venture capitalist. What will a venture capital turnaround feel like? Will it be gradual or sudden? What will change the sentiment in the market? Three months later, Lehman fell & the Global Financial Crisis started.

Let's personalize your content