Battery Ventures: Startups Are Actually Far More Overvalued Now Than in 2021

SaaStr

NOVEMBER 12, 2024

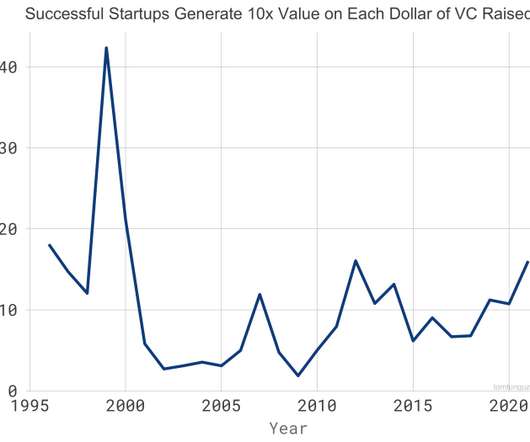

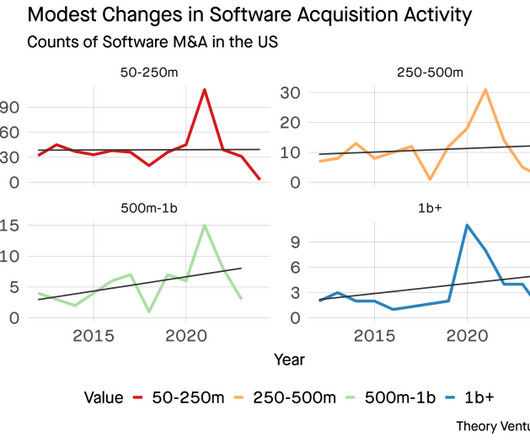

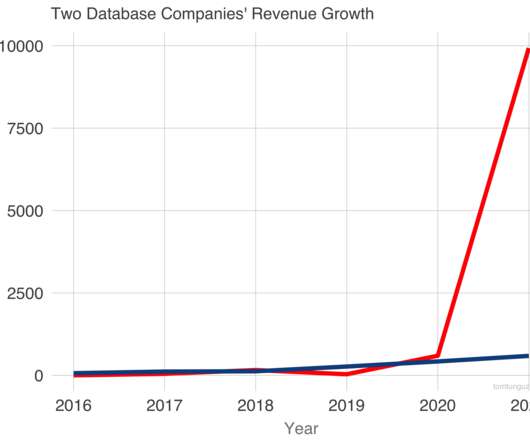

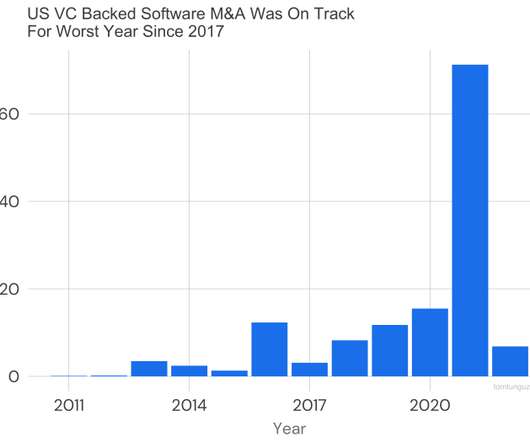

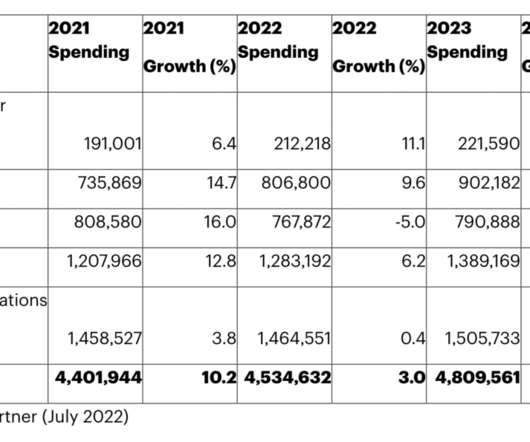

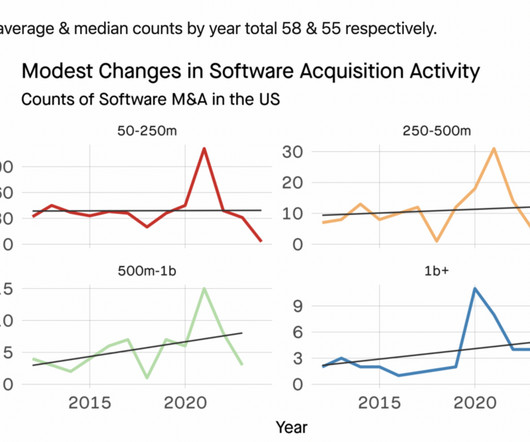

Because valuations are as high as ever, and yet … public software multiples are far, far, far lower than 2021. Battery does believe it’s possible AI can 4x the spend on software and software infrastructure by “stealing” another $3 trillion in spend from service and labor displacement. in 2021 to 23.4x

Let's personalize your content