Surprising Data Points about the Venture Capital Market

Tom Tunguz

AUGUST 7, 2023

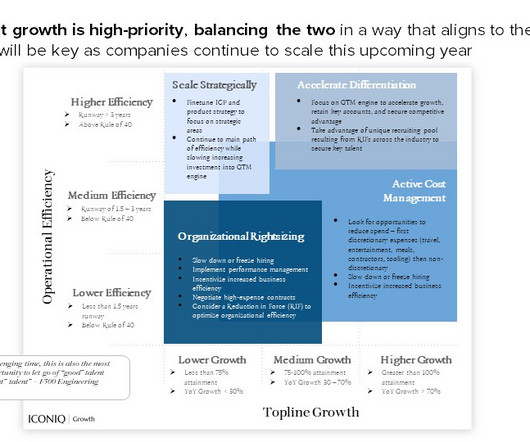

A few data points stood out to me Downrounds constitute 20% of all rounds, up 2x from historical norms. Perhaps there’s a parallel in buyer psychology in software & in venture capital. The greater the employee confidence in a business, the more compelled an investor could be to lead a round.

Let's personalize your content