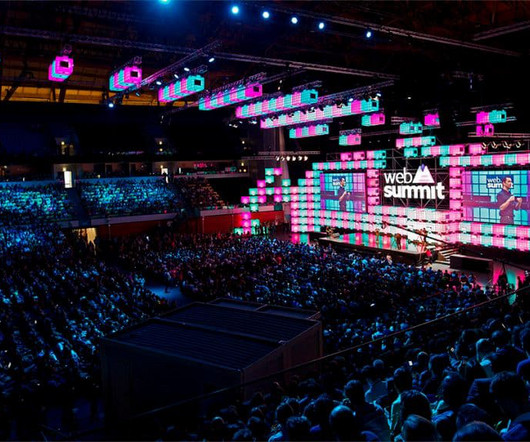

Investing and Venture Capital in 2023 With SaaStr Founder/CEO Jason Lemkin and Atrium Founder/CRO Pete Kazanjy (Pod 624 + Video)

SaaStr

JANUARY 11, 2023

SaaS Founder and CEO Jason Lemkin and Atrium Founder and CRO Pete Kazanjy sit down to discuss the state of investing in 2023 and what founders should keep in mind for the year ahead. . Since 2016, he prefers to make about three or four investments per year, usually within the $1 – $4 million range. . The Backstory.

Let's personalize your content