The Significance of SaaS in the Investment Banking Industry

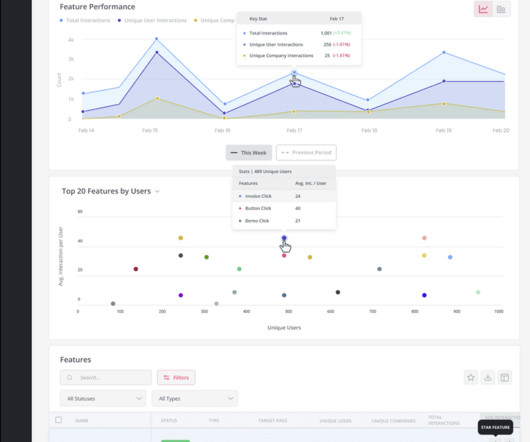

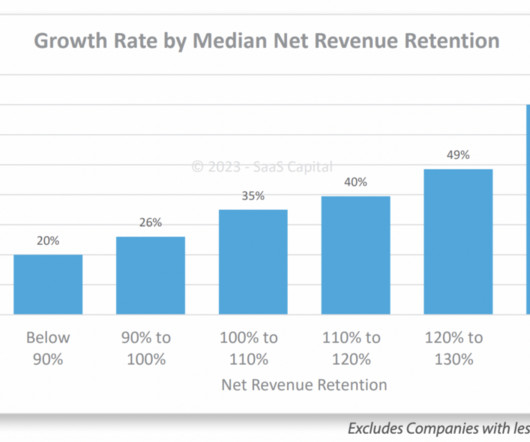

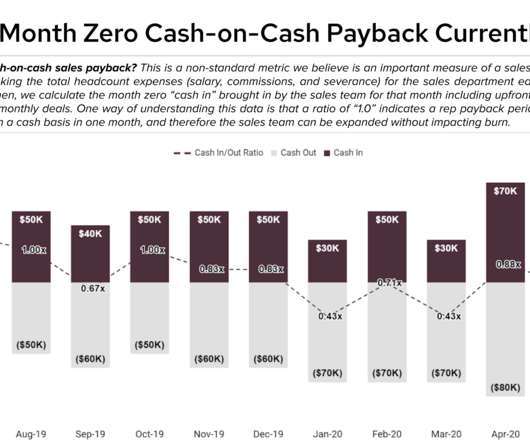

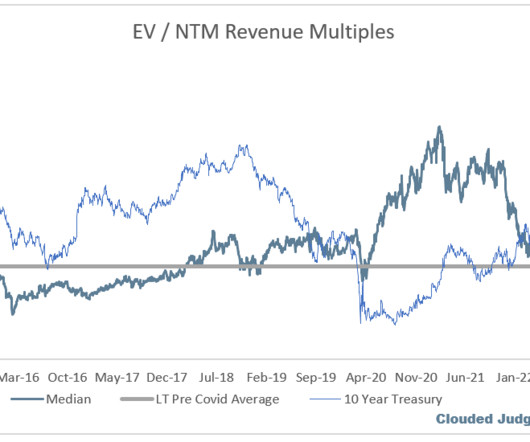

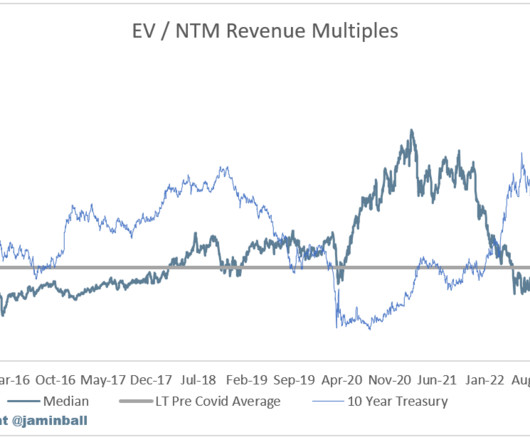

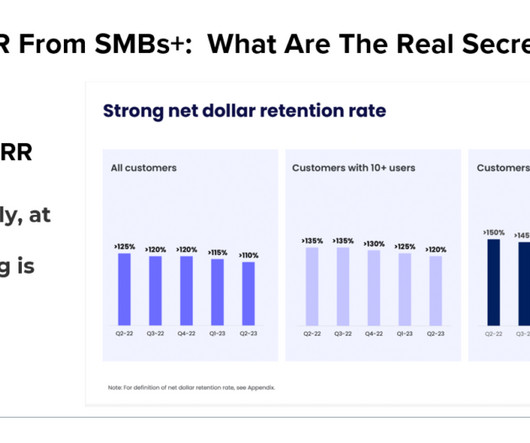

SaaS Metrics

JULY 22, 2023

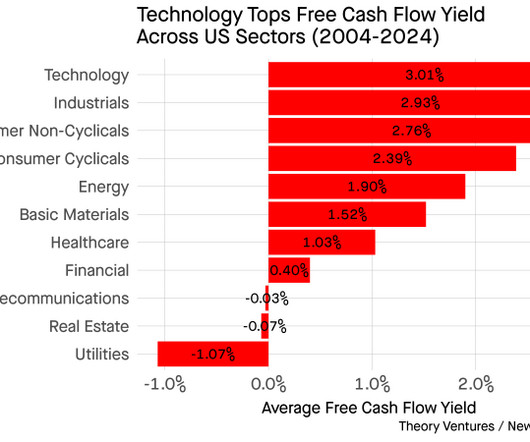

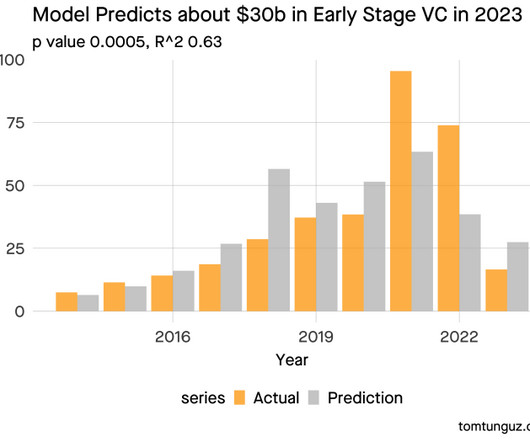

The significance of SaaS in the investment banking industry lies in its ability to improve efficiency and streamline operations, leading to cost savings and enhanced client experiences. Read more The post The Significance of SaaS in the Investment Banking Industry first appeared on SaaS Metrics.

Let's personalize your content