Dear SaaStr: What Are The Rough Benchmarks for Raising a Series A?

SaaStr

JUNE 28, 2025

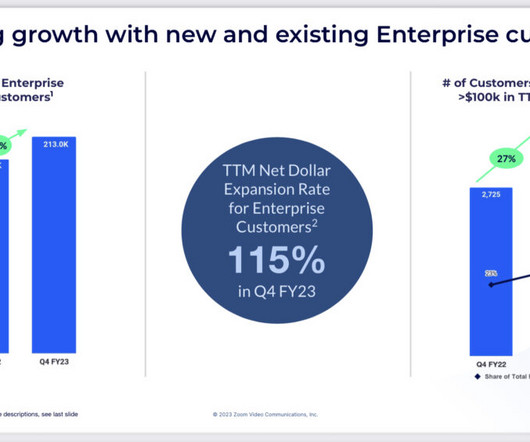

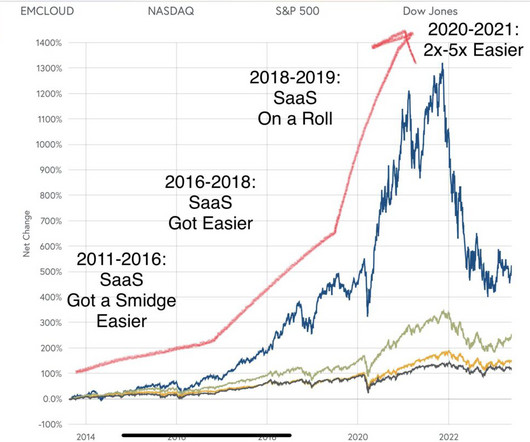

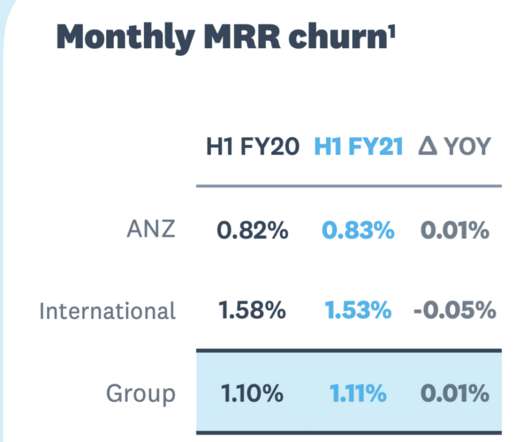

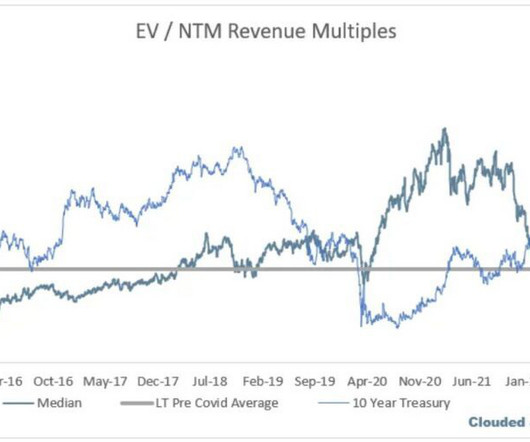

Churn : Low or negative churn is critical. If you’re selling to SMBs, low churn is expected. If you’re selling to mid-market or enterprise, negative churn (expansion revenue outpacing churn) is a strong signal. In 2021, all of SaaS was sort of hot, as long as the growth was strong.

Let's personalize your content