5 Interesting Learnings from UiPath at $600,000,000 in ARR

SaaStr

MARCH 31, 2021

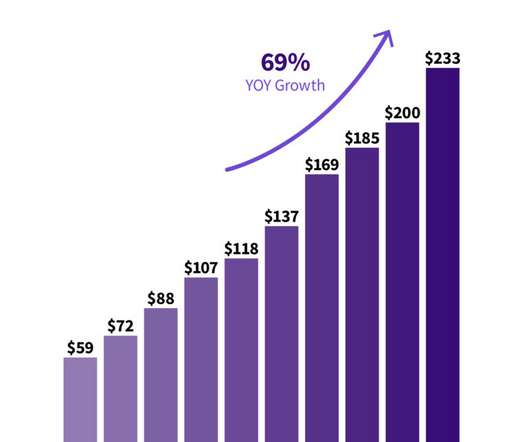

Even ten years on, in 2015, it still had just 10 full-time employees. from 2015 to 2016 … and then exploded: UIPath History. 2015: $1m rev. But since the effective NRR is still 145%, ARR-style metrics still work. Even if a lot of the revenue isn’t truly recurring SaaS revenue. 2014: $500k rev.

Let's personalize your content