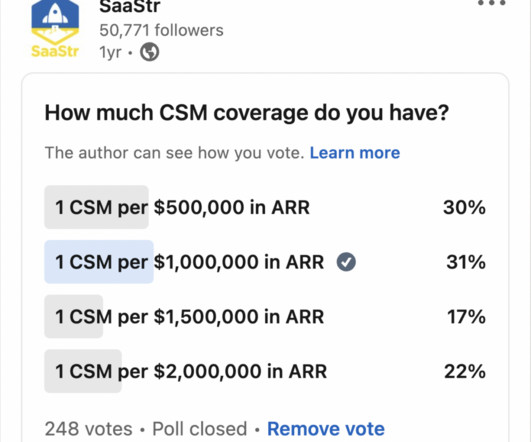

At Scale, Customer Success On Average is Paid 5.3% of ARR Managed, Per Gainsight

SaaStr

OCTOBER 17, 2023

So we’ve been talking about customer success at SaaStr longer than almost anyone else, going back to our very first posts in 2012, including on Second Order Revenue. At SaaStr we’ve huge champions about investing early in CS. CLTV Isn’t The Whole Story. Don’t Shortchange Second-Order Revenue.

Let's personalize your content