Power Laws: A Look Back To Where 20 SaaS Break-Out Companies from 2012 Are Today

SaaStr

JULY 7, 2021

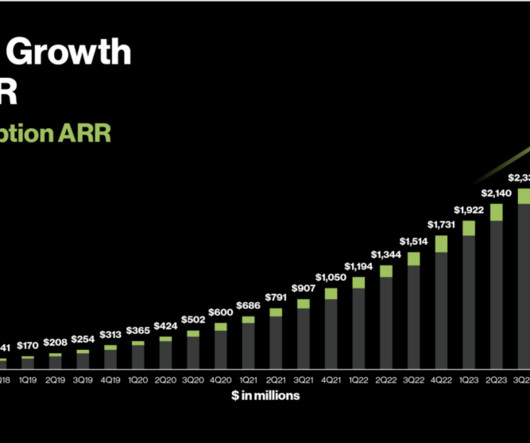

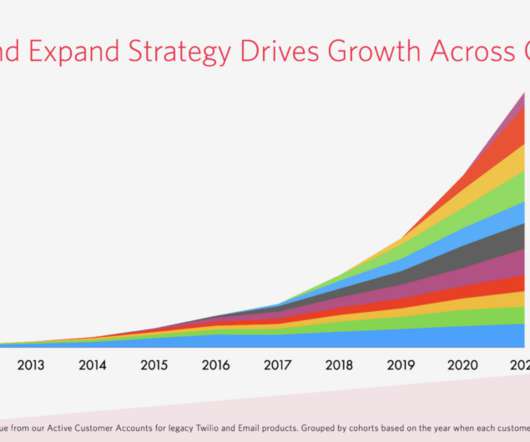

Let’s take a look back at where HubSpot, Upwork, and others were in 2011 GAAP revenue — and where they are today. But to me the takeaways are: If you have something good at $10m ARR, you can scale forever, at least potentially. Learnings for this year, for 2011 GAAP revenue (Inc. in 2011 GAAP revenue.

Let's personalize your content