Of the SaaS Class of 2006, Everyone Great Got to $100,000,000 in ARR. Everyone.

SaaStr

NOVEMBER 13, 2019

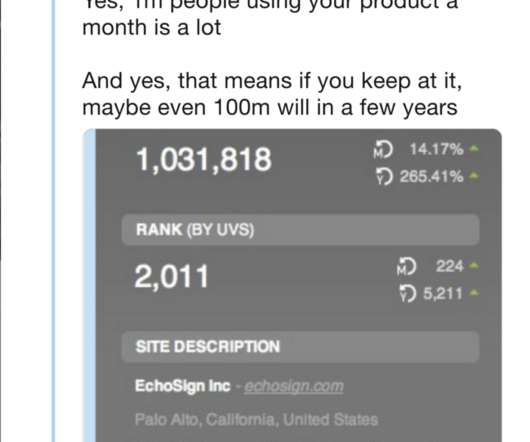

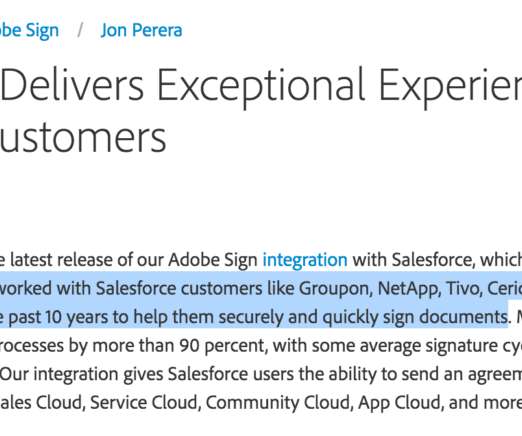

apps of 2006 got to $100,000,000 in ARR: Conga is a pioneer in the document creation and assembly space (as a sponsor of 2020 SaaStr Annual — thank you!!). The interesting part is that (x) every member of the Class of 2006 in SaaS that (y) got to $10m ARR or so with happy customers … (z) got there. Everyone got there.

Let's personalize your content