Bezos' Shareholder Letter in 2000

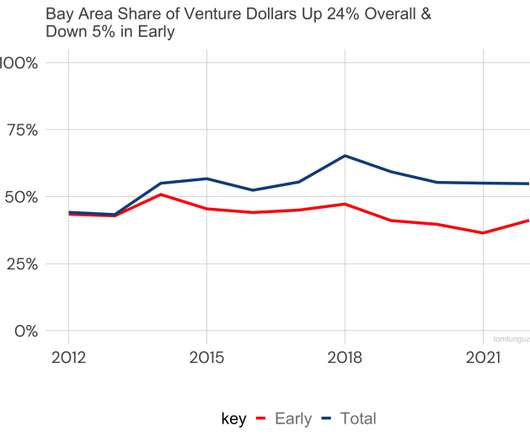

Tom Tunguz

JUNE 19, 2022

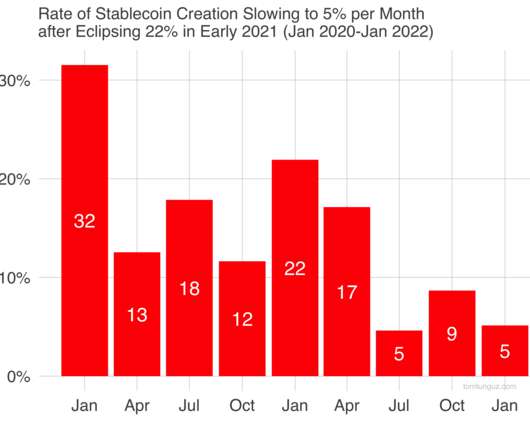

Jeff Bezos wrote this to start his annual shareholder letter in the year 2000. It’s been a brutal year for many in the capital markets and certainly for Amazon.com shareholders. As of this writing, our shares are down more than 80 percent from when I wrote you last year. But he might have written it today. before falling to $0.298.

Let's personalize your content