Building a RevOps structure to increase revenue and customer LTV

Predictable Revenue

JULY 21, 2021

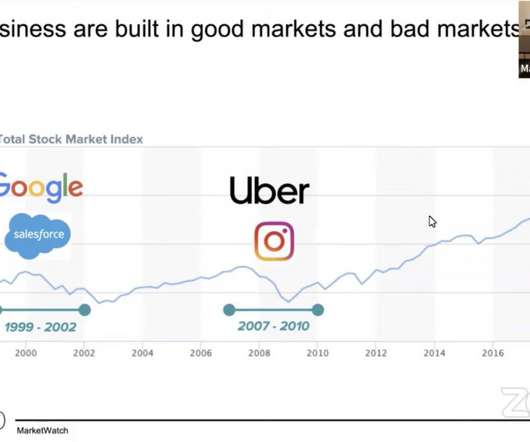

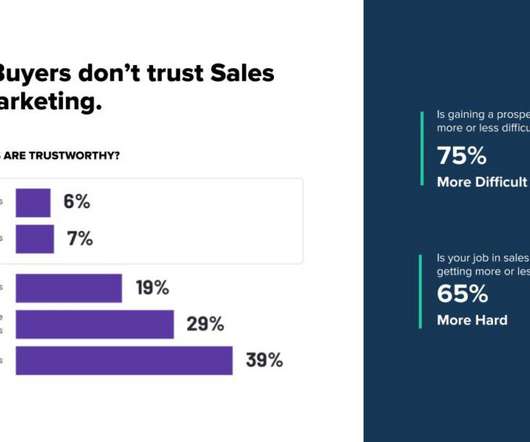

Erol Toker and Rachel Haley explain why RevOps is important, how its evolution is reminiscent of the dot com boom, common mistakes leaders make when building out the RevOps function, and more! The post Building a RevOps structure to increase revenue and customer LTV appeared first on Predictable Revenue.

Let's personalize your content