Dear SaaStr: Is Late-Stage Venture Capital More Stressful than Early-Stage Venture Capital?

SaaStr

JULY 5, 2023

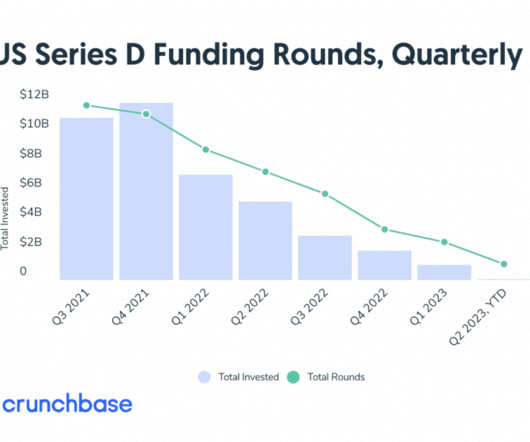

Dear SaaStr: Is Late-Stage Venture Capital More Stressful than Early-Stage Venture Capital? You’re often betting on a $10B+ IPO, and that’s just pretty darn rare these days in SaaS and Cloud. It’s more lamentful , I think. And probably even most of the companies you meet with are, too.

Let's personalize your content