How Much Should You Expect Your Startup to Slow in 2022?

Tom Tunguz

JULY 28, 2022

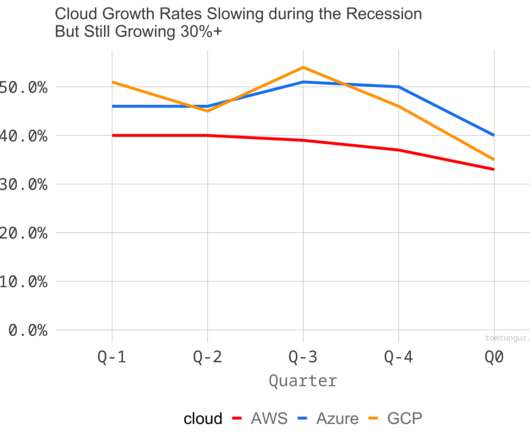

AWS announced earnings earlier today and reported 33% growth. AWS’s growth rate is the slowest of the three largest public infrastructure clouds. With about 39% market share, AWS reigns supreme as the largest provider. With about 39% market share, AWS reigns supreme as the largest provider. Q/Q Growth Rate Change.

Let's personalize your content