How The Stange and Odd World of Financial Accounting Drives Tech Acquisitions and Investments

SaaStr

SEPTEMBER 14, 2023

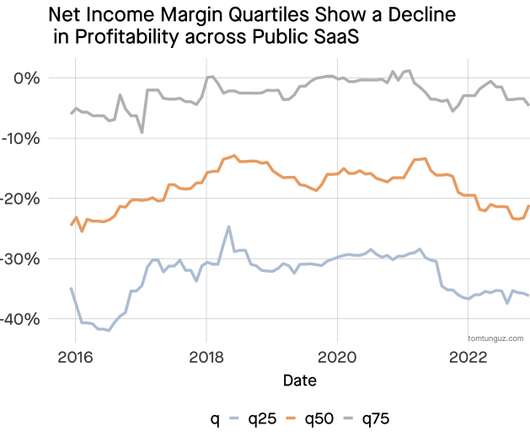

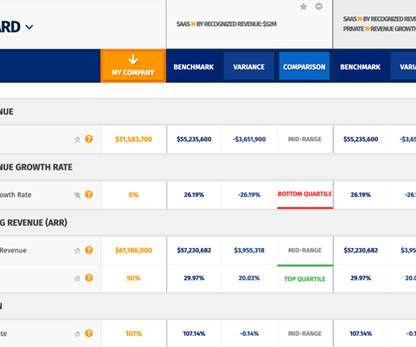

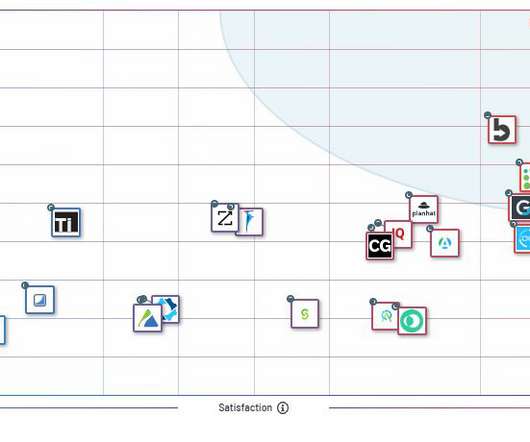

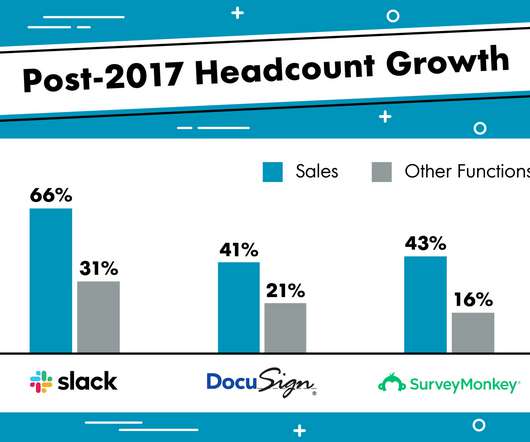

But with that out of the way, let’s talk just enough about financial accounting to explain why Big Tech Companies both acquire smaller ones — and do corporate VC investment. Because in the short-term, it often costs basically close to nothing to acquire a smaller startup with cash on hand, or do a corporate VC investment.

Let's personalize your content