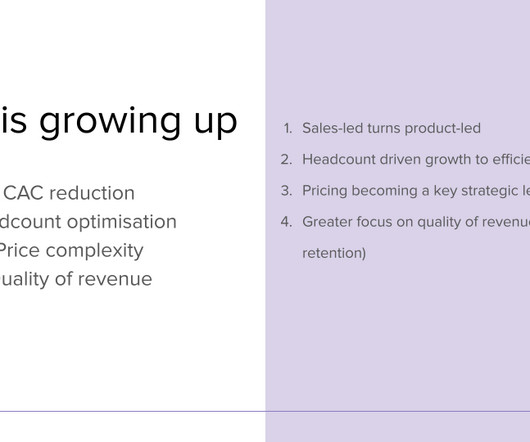

SaaS Is Growing Up: 4 Business Model Changes To Adopt with Notion Capital

SaaStr

SEPTEMBER 19, 2023

PST, Stephanie Opdam, Partner at Notion Capital, shares four business model changes that will allow SaaS companies to build resilience and staying power over time. The right-hand graph shows that deal count and overall investments have fallen. PLG is about investing in product and data instead of sales and marketing.

Let's personalize your content