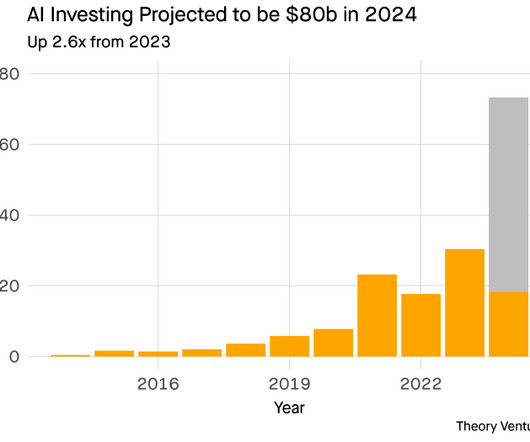

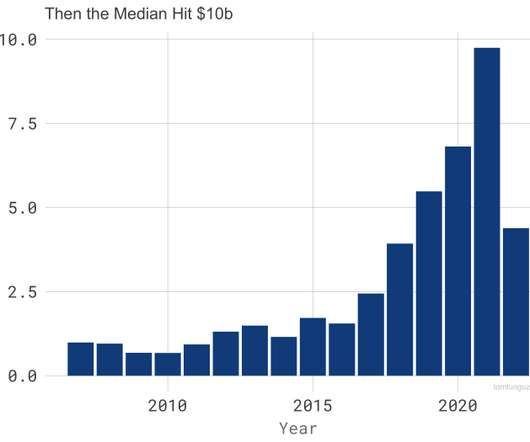

The Fastest Growing Category of Venture Investment in 2024

Tom Tunguz

MAY 8, 2024

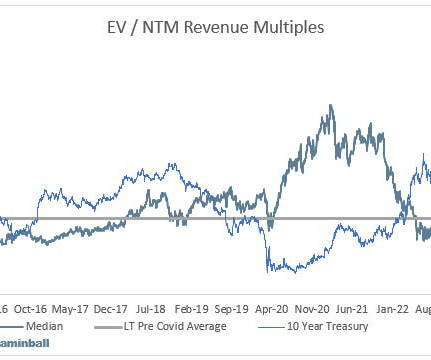

The fastest growing category of US venture investment in 2024 is AI. Venture capitalists have invested $18.3 But after the launch of ChatGPT in 2022, there’s a marked inflection point. Some of this is new company formation, & there has been a significant amount of seed investment in this category.

Let's personalize your content