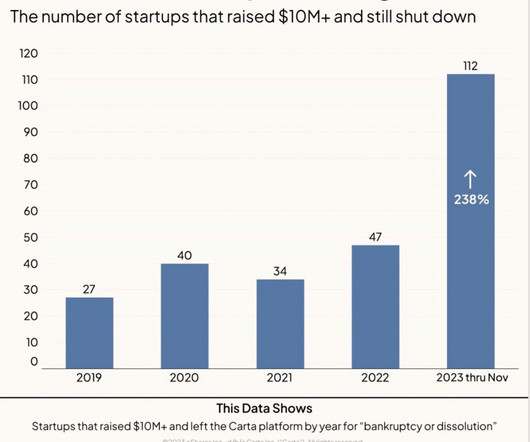

Carta: Startup Shutdowns Are Up 237%

SaaStr

DECEMBER 2, 2023

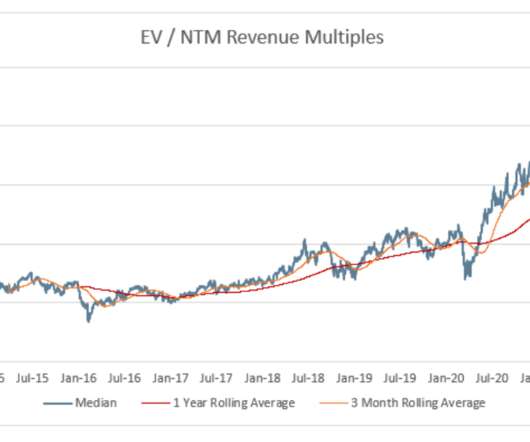

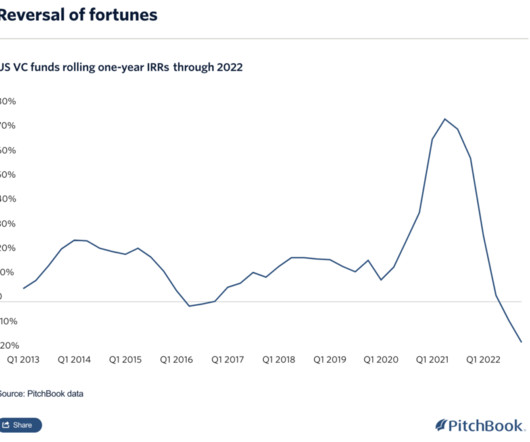

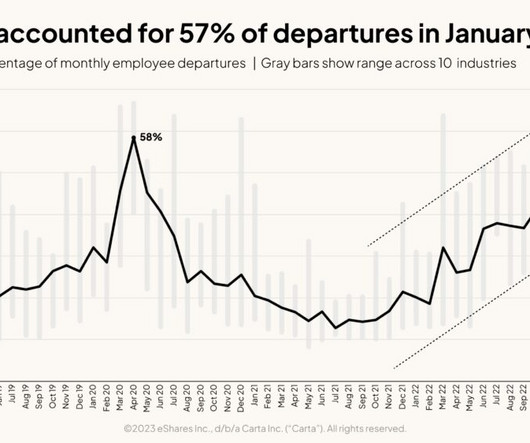

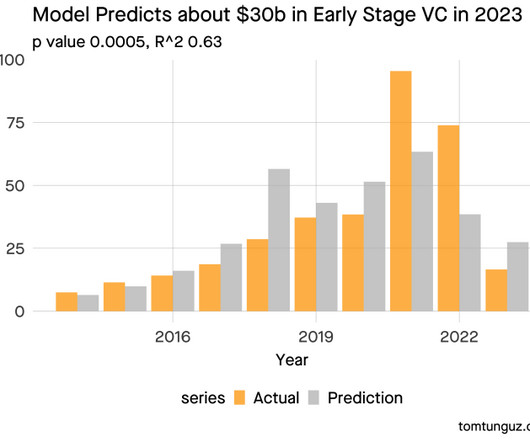

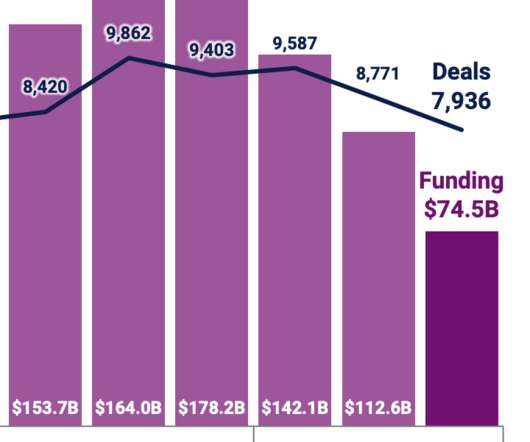

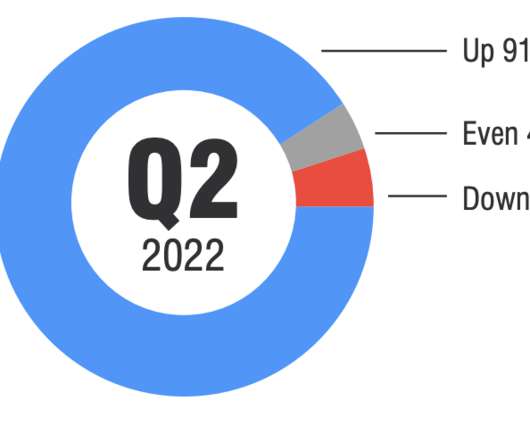

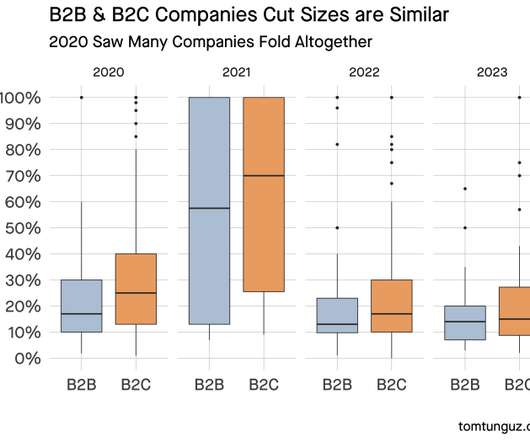

But for many startups, the hangover from the Excesses of 2021 is a real and tough one. And the latest Carta data here supports that. Startups shutting down are up 238% this year — already. So, so many SaaS startups got funded in the Boom, and they just can’t all make it. But Be Kind.

Let's personalize your content