Only 11% of Unicorn Exits Are IPOs Now (Down from 53%)

SaaStr

JULY 9, 2025

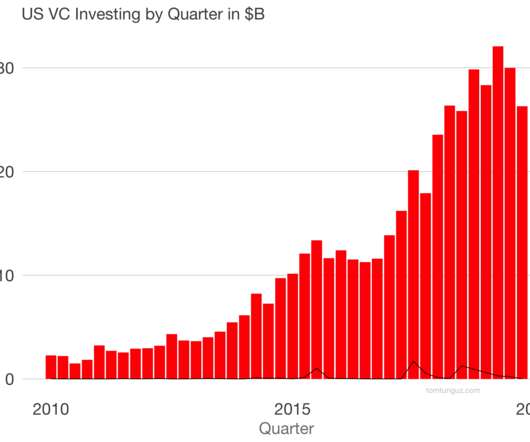

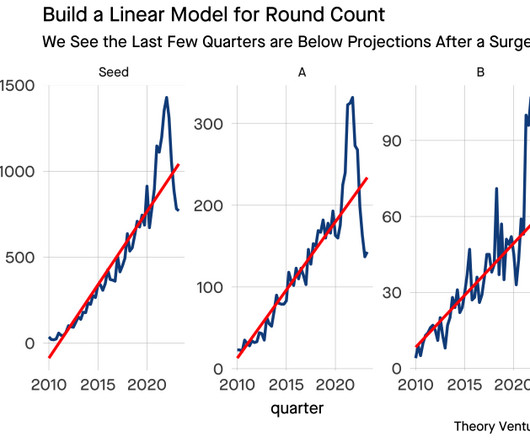

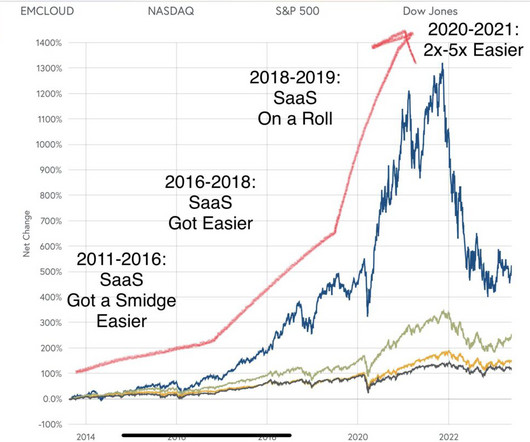

The data, compiled by Stanford’s Venture Capital Initiative, shows IPO share of unicorn exits dropped from 83% in 2010 to just 11% in 2024—a fundamental restructuring of the exit landscape that has permanent implications for SaaS founders. The data is stark: IPO share of unicorn exits dropped from 83% to 11% between 2010 and 2024.

Let's personalize your content