The Vertical SaaS Gold Rush: Why Non-Tech B2B Is Growing 250%+ Faster

SaaStr

JULY 4, 2025

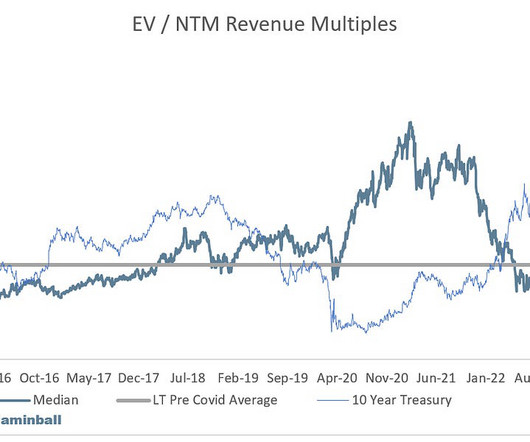

The Numbers Tell the Story: Monday.com Q1 2025 : 30% growth, $282M revenue Asana 2024 : Single-digit growth, struggling with churn Mostly Same Product Category, Mostly Different Customers Both companies build “work management” software. Try replacing Samsara when it’s monitoring your entire fleet for DOT compliance.

Let's personalize your content