The Investments Where I’m Going to Lose All My Money

SaaStr

MARCH 26, 2024

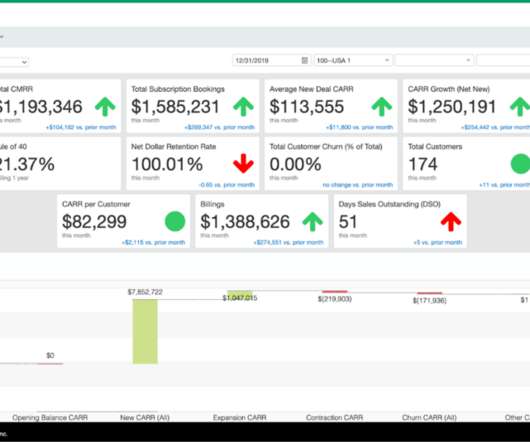

Since then, I’ve made some pretty good other investments as well. The top reasons an investment has turned out to be a Zero: #1. If revenue was overstated a bit. If the founders hide churn, or hide a co-founder is leaving, or really anything that much matters — again, it’s just a smoking gun.

Let's personalize your content