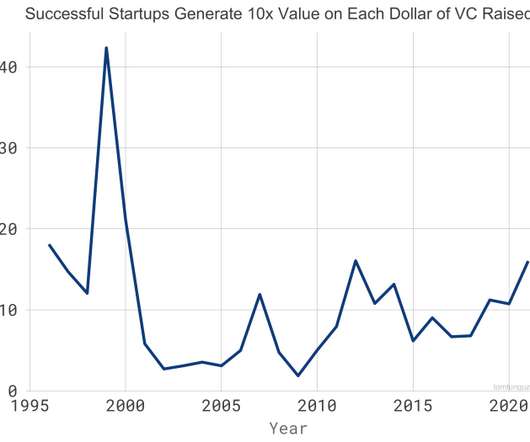

The Math Behind Starting a Successful Software Startup

Tom Tunguz

AUGUST 1, 2022

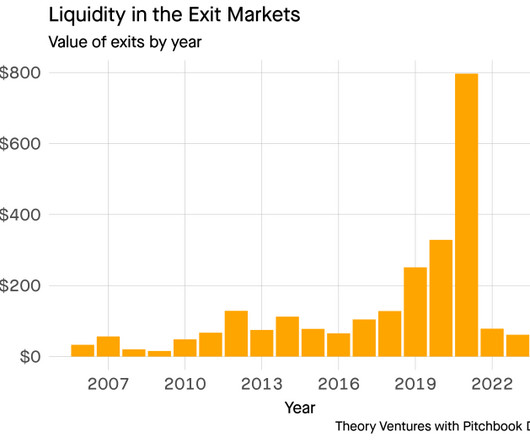

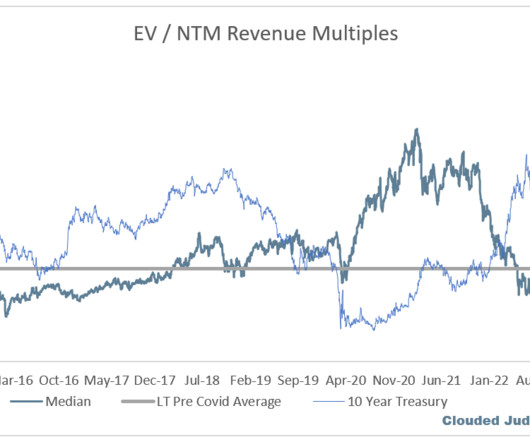

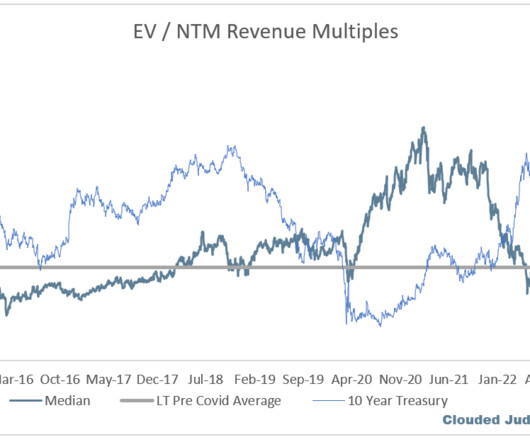

How much value does a successful software startup create per dollar of venture investment? Over the last 30 years, a venture dollar invested in a successful US software startup generated $10 of value. In addition to MOIC patterns, the data reveals three startup fundraising epochs. In the 2000s, about $30m.

Let's personalize your content