Trends In Startup Acquisition Market in 2015

Tom Tunguz

JUNE 29, 2015

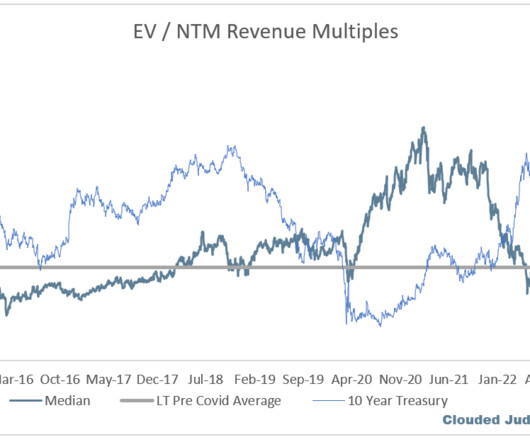

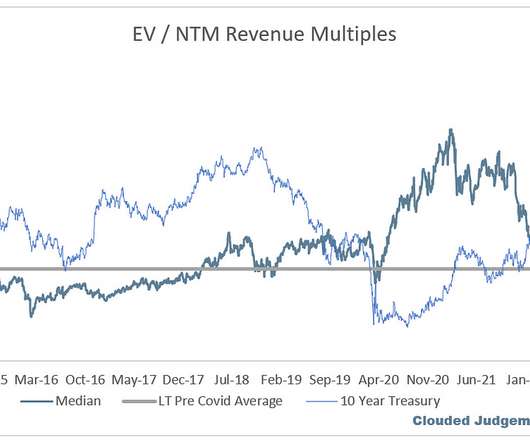

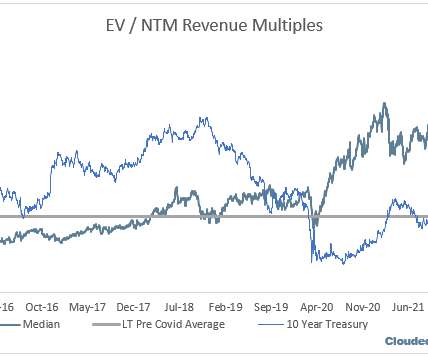

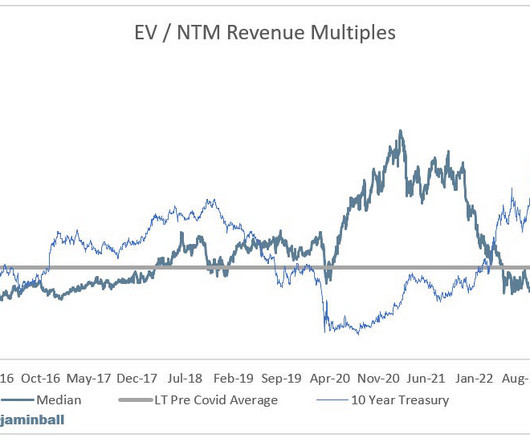

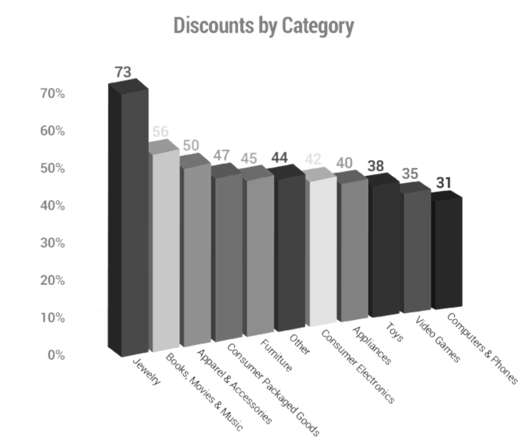

As of mid-2015, the first trend continues while the second seems to have faltered. The median acquisition price for technology companies in Crunchbase’s data set is plotted above, bucketed by size. But M&A velocity has slowed in 2015 compared to 2014 - at least through the first quarter.

Let's personalize your content