Trends In Startup Acquisition Market in 2015

Tom Tunguz

JUNE 29, 2015

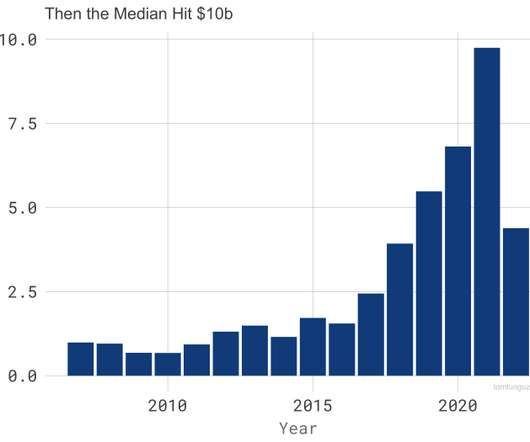

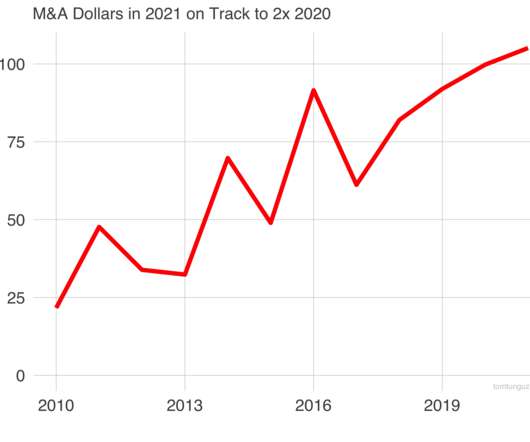

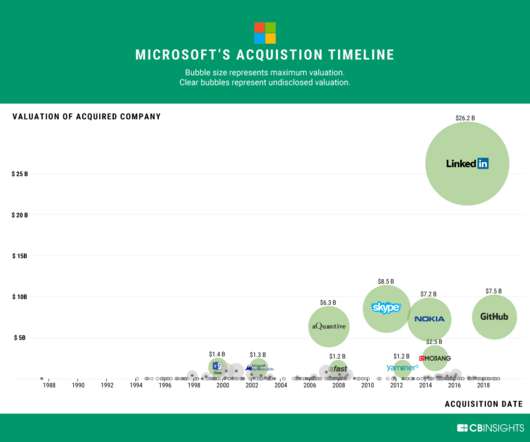

As of mid-2015, the first trend continues while the second seems to have faltered. But M&A velocity has slowed in 2015 compared to 2014 - at least through the first quarter. 2015 Q1 activity, meanwhile, has declined. It’s hard to say why M&A and IPO activity have seen declines in 2015.

Let's personalize your content