Massive Acquisitions in Software Startups

Tom Tunguz

APRIL 28, 2024

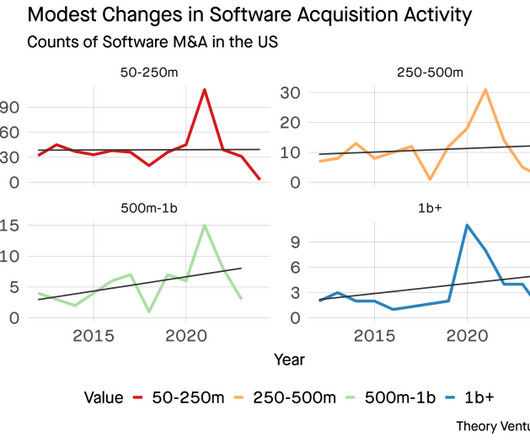

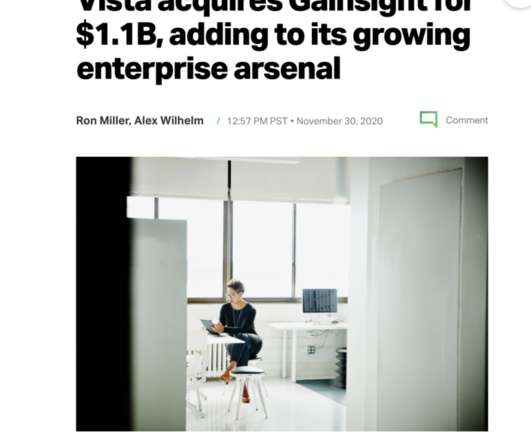

What drives the acquisition market of startups? In the last decade, the total number of venture backed software M&A by count has remained relatively constant. The black line shows the linear trend across US venture backed companies with disclosed values of $50m or more. It’s the big deals. X 2015 20.1% - 2016 43.0%

Let's personalize your content