How Will a Venture Capital Recovery Feel? Observations from 2008

Tom Tunguz

AUGUST 6, 2023

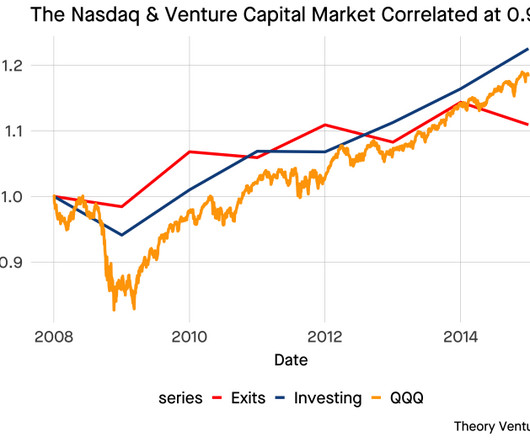

What will a venture capital turnaround feel like? In 2008, I had just become a venture capitalist. With 15 years’ perspective, I plotted the QQQ (Nasdaq) value against venture Investing activity & venture Exits activity (all log normalized). for QQQ/Investing & 0.93 for QQQ/Exits.

Let's personalize your content