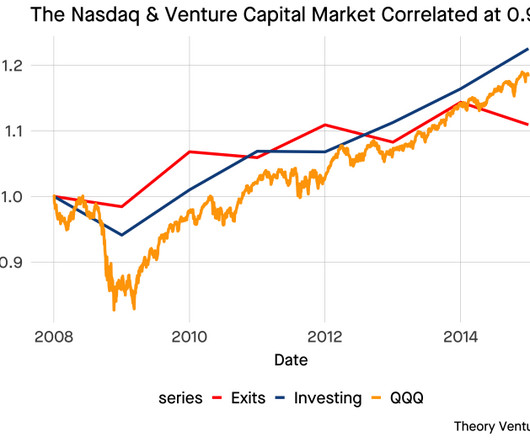

How Will a Venture Capital Recovery Feel? Observations from 2008

Tom Tunguz

AUGUST 6, 2023

What will a venture capital turnaround feel like? In 2008, I had just become a venture capitalist. In the first two quarters of 2011, Cornerstone OnDemand waded into the IPO market in 2011, followed by LinkedIn at $4.2b, Homeaway at $2.1b, Fusion.io Will it be gradual or sudden?

Let's personalize your content