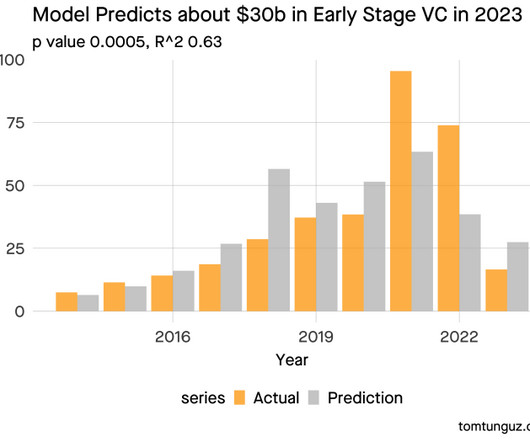

Passive Investing in Venture Capital and the Parallels to Public Equities

Tom Tunguz

OCTOBER 7, 2021

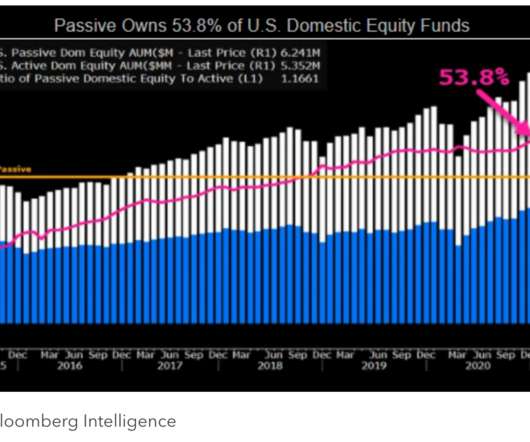

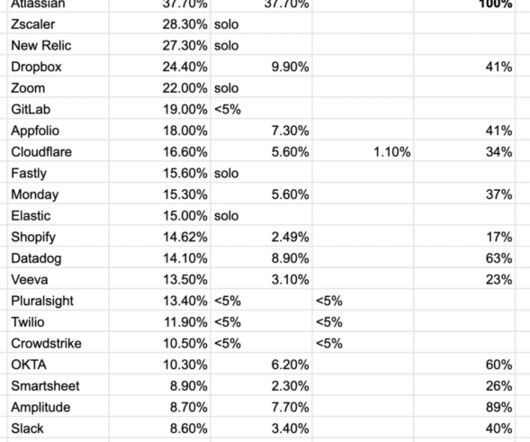

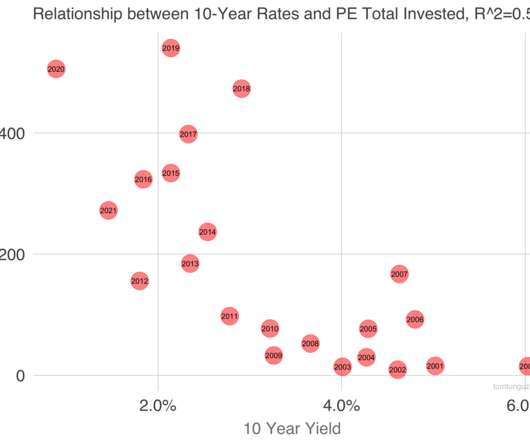

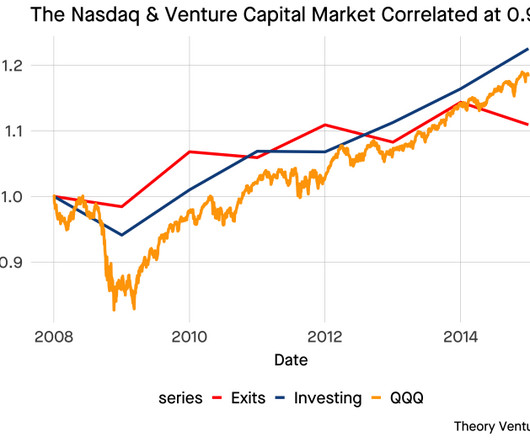

Passive venture capital investing is a relatively new idea. As later stage investors permeate venture capital, they are amassing index funds of startups. If the public equities market is any indication, passive investing is here to stay. Classically, venture capital has been an active asset class.

Let's personalize your content