Card Machines: 6 Ways to Save Money on Payment Processing Equipment

Stax

MARCH 11, 2024

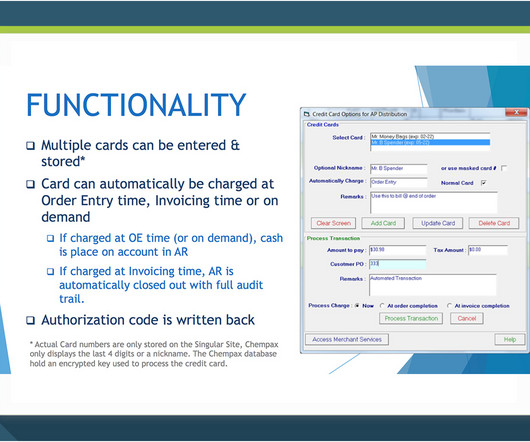

Owners are encouraged to ask for help from their point of sales representatives or other providers. Both systems interact throughout the sales. Your POS system takes the card payment, while the processing provider transfers the funds. POS and Payment Processing Providers don’t necessarily need credit card terminals.

Let's personalize your content